Page 226 - 香港房屋協會 Hong Kong Housing Society Annual Report 2020/2021

P. 226

224

HONG KONG HOUSING SOCIETY ANNUAL REPORT 2020/21

17. Investment related financial assets/liabilities

(continued)

At the end of the reporting period, the weighted average yield to maturity rate of global fixed income is 1.63 per cent (2020: 2.37 per cent) and weighted average duration is 7.73 years (2020: 7.66 years).

On investment related financial liabilities, 20 per cent (2020: 31 per cent) is due for settlement within 30 days after the end of the reporting period.

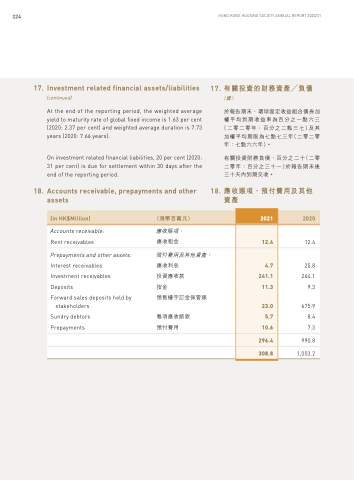

18. Accounts receivable, prepayments and other assets

17. 有關投資的財務資產╱負債 (續)

18.

於報告期末,環球固定收益組合債券加

權平均到期收益率為百分之一點六三 (二零二零年:百分之二點三七)及其 加權平均期限為七點七三年(二零二零

年:七點六六年)。

有關投資財務負債,百分之二十(二零 二零年:百分之三十一)於報告期末後 三十天內到期交收。

應收賬項、預付費用及其他 資產

(in HK$Million) (港幣百萬元)

2021

2020

Accounts receivable:

應收賬項:

Rent receivables

應收租金

12.4

12.4

Prepayments and other assets:

預付費用及其他資產:

Interest receivables

應收利息

4.7

25.8

Investment receivables

投資應收款

241.1

264.1

Deposits

按金

11.3

9.3

Forward sales deposits held by stakeholders

預售樓宇訂金保管賬

23.0

675.9

Sundry debtors

雜項應收賬款

5.7

8.4

Prepayments

預付費用

10.6

7.3

296.4

990.8

308.8

1,003.2