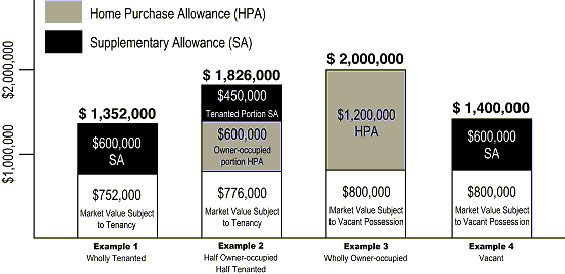

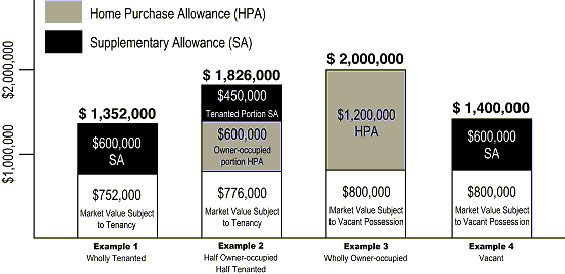

|

Examples

of Calculation of SA

(Figures are based on assumption and for reference only)

HPA is the difference between the market value of the property being

acquired and the cost of a notional replacement flat on vacant basis

of 7-year old in the same general locality and having similar size

as that of the property. SA is an allowance payable to an owner

who partially or wholly leases out the property or leaves the property

vacant.

Assuming the market value of a domestic flat on vacant possession

(VP) basis is HK$800,000 and the cost of a replacement flat of 7-year old and similar size in the same general locality is HK$2,000,000.

The HPA will then assumed to be HK$1,200,000.

Example One

An owner of the above domestic flat who lets out the entire flat

This owner will get the market value of his flat (subject to tenancy)

of HK$752,000 (HK$800,000 x 94%) and SA of HK$600,000 (HK$1,200,000

x 50%). In total, this owner will receive HK$1,352,000.

Example Two

An owner of the above domestic flat who occupies half of the

flat and leases out the other half

This owner will get the market value of his flat (subject to tenancy)

of HK$776,000 (HK$400,000 + HK$400,000 x 94%) and HPA of HK$600,000

for the owner-occupied portion and SA of HK$450,000 (HK$600,000

x 75%) for the tenanted portion. In total, this owner will receive

HK$1,826,000.

Example Three

An owner of the above domestic flat who occupies the entire flat

for his own use

This owner will get the market value of his flat (VP), which is

HK$800,000, plus HPA which is HK$1,200,000. In total, this owner

will receive HK$2,000,000.

Example Four

An owner of the above domestic flat who leaves the entire flat

vacant

The owner will get the market value of his flat (VP), which is HK$800,000,

plus SA of HK$600,000 (HK$1,200,000 x 50%). In total, this owner

will receive HK$1,400,000.

|

|