Page 207 - 香港房屋協會 Hong Kong Housing Society Annual Report 2020/2021

P. 207

香港房屋協會 2020/21 年度年報

205

AUDITED FINANCIAL STATEMENTS 已審核財務報表 NOTES TO THE FINANCIAL STATEMENTS 財務報表附註

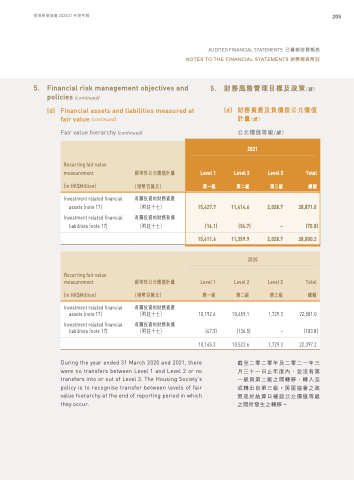

5. Financial risk management objectives and policies (continued)

(d) Financial assets and liabilities measured at fair value (continued)

Fair value hierarchy (continued)

5. 財務風險管理目標及政策(續) (d) 財務資產及負債按公允價值

計量(續) 公允價值等級(續)

2021

Recurring fair value measurement

經常性公允價值計量

Level 1

Level 2

Level 3

Total

(in HK$Million) (港幣百萬元)

第一級

第二級

第三級

總額

Investment related financial assets (note 17)

有關投資的財務資產 (附註十七)

15,427.7

11,414.6

2,028.7

28,871.0

Investment related financial liabilities (note 17)

有關投資的財務負債 (附註十七)

(16.1)

(54.7)

–

(70.8)

15,411.6

11,359.9

2,028.7

28,800.2

2020

Recurring fair value measurement

經常性公允價值計量

Level 1

Level 2

Level 3

Total

(in HK$Million) (港幣百萬元)

第一級

第二級

第三級

總額

Investment related financial assets (note 17)

有關投資的財務資產 (附註十七)

10,192.6

10,659.1

1,729.3

22,581.0

Investment related financial liabilities (note 17)

有關投資的財務負債 (附註十七)

(47.3)

(136.5)

–

(183.8)

10,145.3

10,522.6

1,729.3

22,397.2

During the year ended 31 March 2020 and 2021, there were no transfers between Level 1 and Level 2 or no transfers into or out of Level 3. The Housing Society’s policy is to recognise transfer between levels of fair value hierarchy at the end of reporting period in which they occur.

截至二零二零年及二零二一年三 月三十一日止年度內,並沒有第 一級與第二級之間轉移、轉入至 或轉出自第三級。房屋協會之政 策是於結算日確認公允價值等級 之間所發生之轉移。