Hong Kong Housing Society Annual Report 2014

146

Notes to the Financial Statements

ৌਕజ

ڝڌ

ൗ

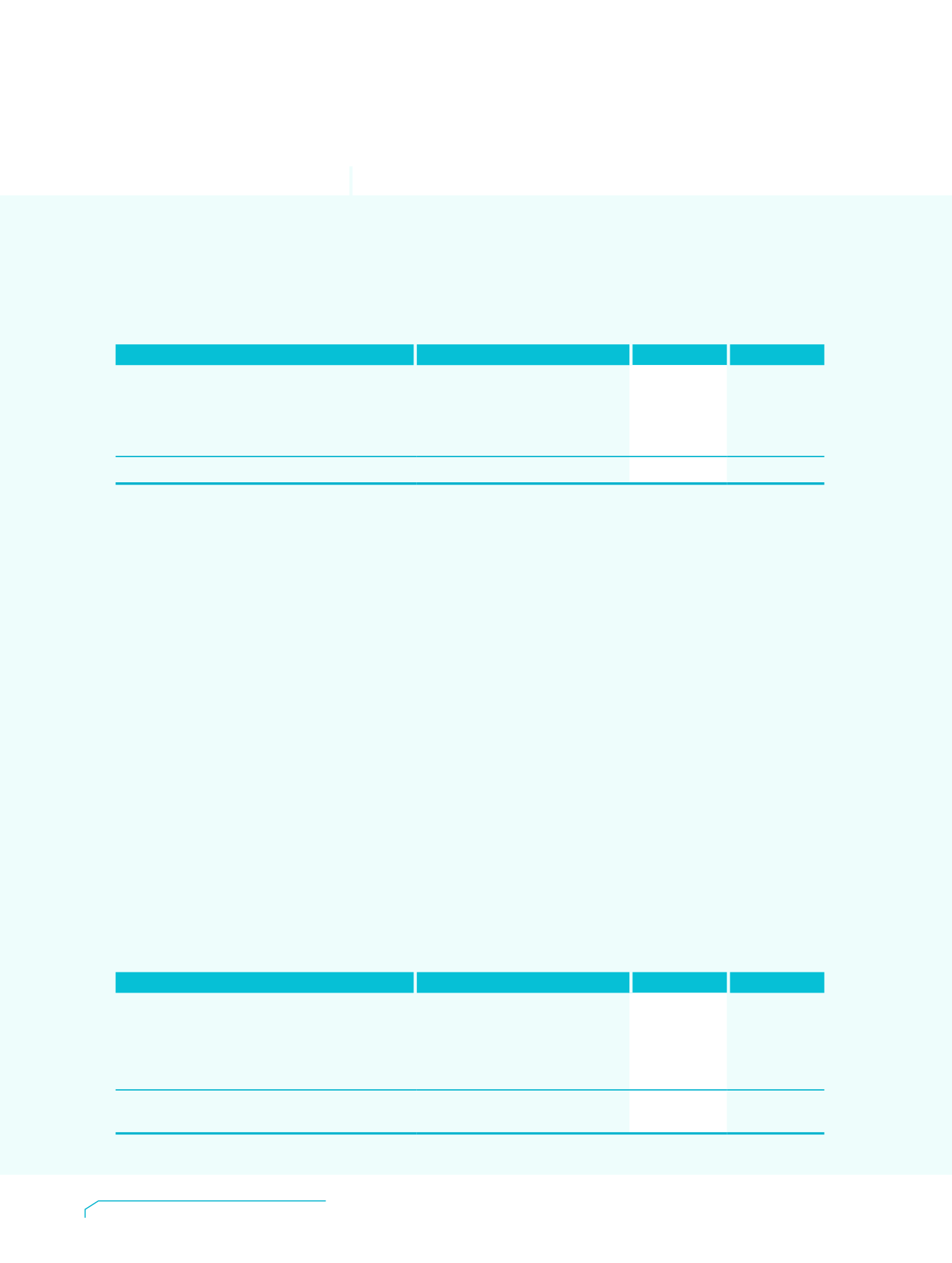

22 Operating lease arrangements

At the end of the reporting period, the Housing Society had

contracted with tenants for future minimum lease payments under

non-cancellable operating leases in respect of rented premises which

fall due as follows:

22

營運租約安排

於報告期末,房屋協會與其租戶就有關

出租物業的不可取消營運租約,於下列

到期時限的最少租金收入:

(in HK$Million)

(港幣百萬元)

2014

2013

Within 1 year

一年內

442.8

313.4

2 to 5 years

兩至五年內

261.4

201.4

Over 5 years

五年以後

19.0

19.0

723.2

533.8

大部分的租約期限為二至三年。除部分

停車場其租金按該停車場營運商之總營

業額的百分比計算,其他租金在租約期

內一般是固定的。

23

退休金褔利計劃

房屋協會為其合資格僱員提供兩個界定

供款退休金計劃,分別為「定額供款退

休保障計劃」及「強制性公積金計劃」。

該等計劃的資產與房屋協會的資產乃分

開持有,並存於由獨立信託人所管理的

基金內。

房屋協會按退休褔利計劃所指定的比

率計算應付退休供款,並全數列入全

面收支表內。就「定額供款退休保障計

劃」,倘僱員於全數達到享用退休褔利

前退出該計劃,被沒收僱主供款可用於

減除房屋協會應付的未來供款、或支付

信託人行政費用、或根據此計劃條款分

配給參與此計劃的僱員。

Majority of the leases are negotiated for terms ranging from two to

three years. Rentals are generally fixed over the lease terms except

that rental of certain car parks is calculated on a percentage of their

respective car parks operator’s gross revenue.

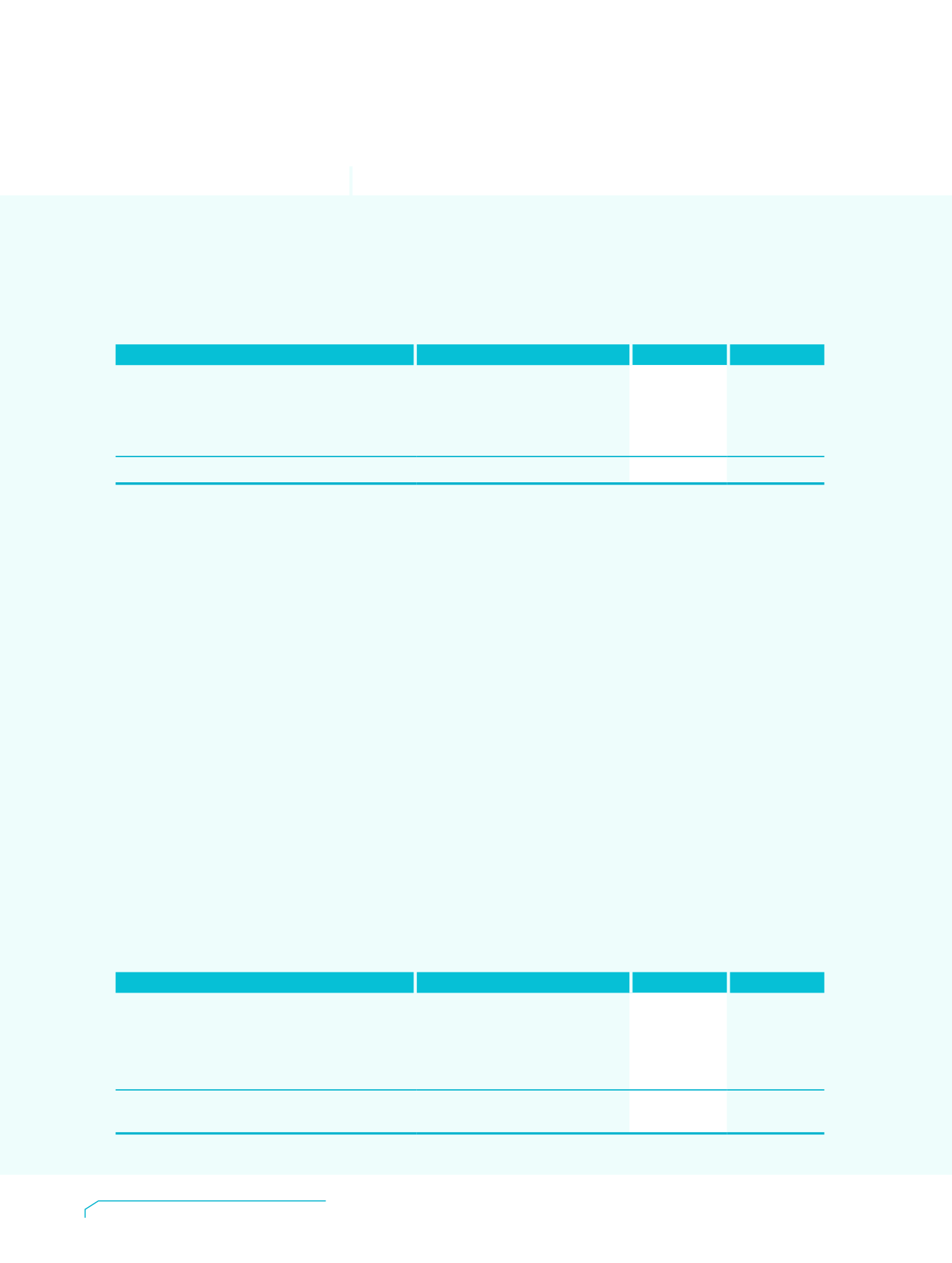

23 Retirement benefits schemes

The Housing Society operates two defined contribution retirement

benefits schemes, namely, Defined Contribution Retirement Benefit

Scheme and Mandatory Provident Fund Scheme, for all qualifying

employees. The assets of the schemes are held separately from those

of the Housing Society in the funds under the control of trustees.

The retirement benefits cost charged to the statement of

comprehensive income represents contribution payable to the funds

by the Housing Society at rates specified in the rules of the schemes.

Regarding the Defined Contribution Retirement Benefit Scheme,

where there are employees who leave the scheme prior to vesting fully

in the contributions, the forfeited employer’s contributions are used

either to reduce future contribution or to pay the trustee’s

administration charges or to distribute to members who are entitled to

such distributions under the rules of the scheme.

(in HK$Million)

(港幣百萬元)

2014

2013

Contribution to the schemes (net of forfeiture)

計劃供款(已扣減沒收供款)

28.9

28.3

Utilisation of forfeited employer’s contribution for

payment of trustee’s administration charges

contribution for:

被沒收的僱主供款用於支付信託人

行政費用

0.5

0.5

Balance of forfeited employer’s contribution not

utilised at 31 March

於三月三十一日未運用的被沒收

僱主供款結餘

1.8

2.1