Hong Kong Housing Society Annual Report 2014

108

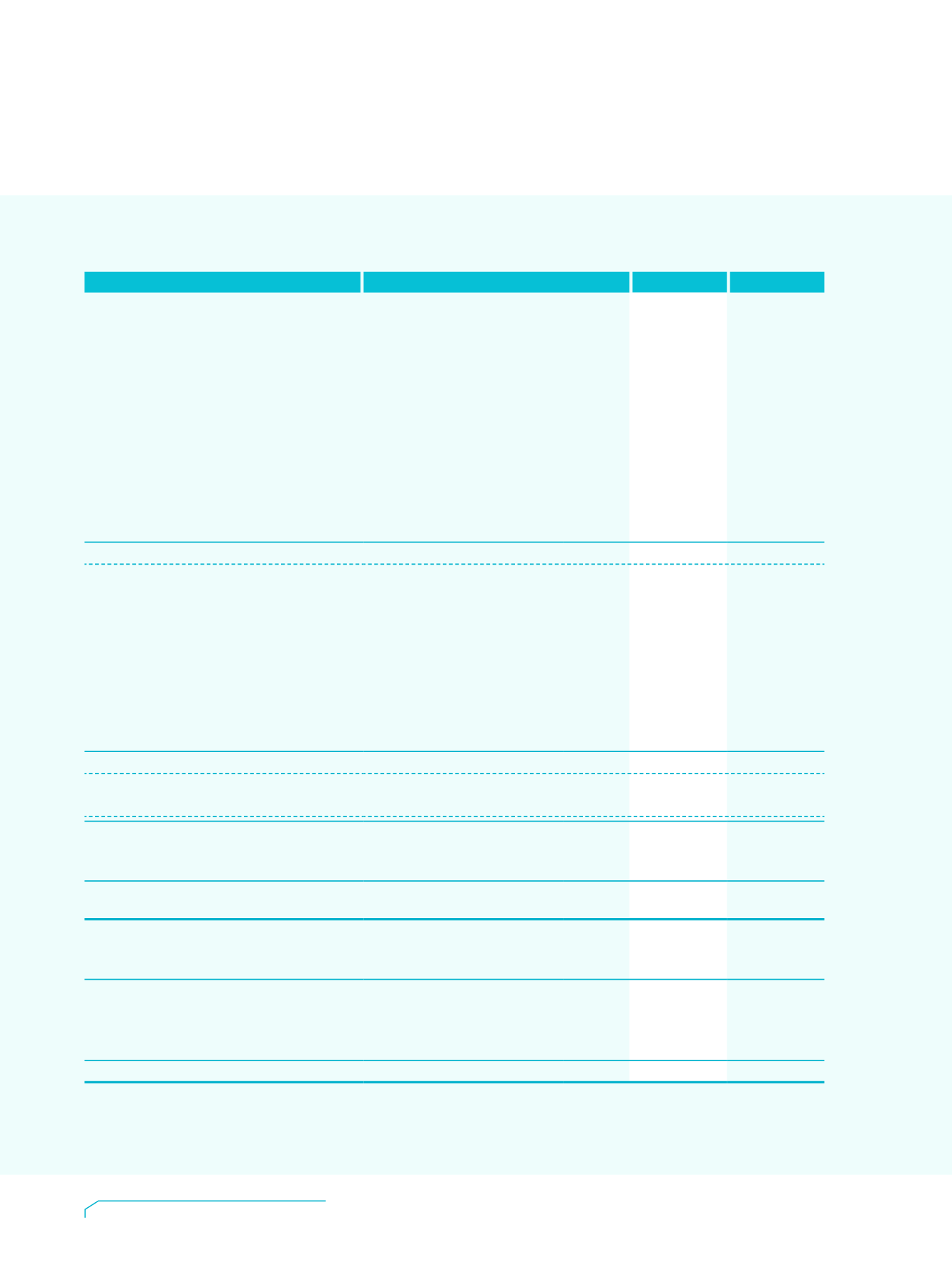

Statement of Cash Flows

現金流量表

for the year ended 31 March 2014

截至二零一四年三月三十一日止年度

(in HK$Million)

(港幣百萬元)

2014

2013

Operating activities

營運活動

Cash receipts from tenants

從租客所收取的現金

1,191.8

1,113.0

Cash receipts from flat buyers

從樓宇買家所收取的現金

552.3

1,062.1

Cash receipts from property owners

從樓宇業主所收取的現金

31.6

21.8

Cash payments for property leasing and

management

屋宇租賃及管理的現金支出

(336.9)

(377.1)

Cash payments for site acquisition and

project development

收購土地及發展成本現金支出

(1,175.7)

(673.3)

Cash payments to employees in respect of

salaries and other benefits

員工薪酬及褔利現金支出

(422.1)

(396.8)

Cash payments for social projects

回饋項目現金支出

(46.0)

(41.8)

Other cash payments

其他現金支出

(115.7)

(97.1)

Net cash (used in)/generated from operating activities

營運活動現金(流出)/流入淨額

(320.7)

610.8

Investing activities

投資活動

Interest received

利息收入

299.7

294.8

Dividends received

股息收入

121.8

104.4

Release /(placement) of time deposits

定期存款放出 /(置入

)

617.6

(1,034.7)

Payment for redevelopment/

rehabilitation of investment properties

投資物業重建 /復修支出

(437.6)

(453.5)

Payment for property and equipment

物業及設備支出

(10.8)

(41.0)

Payment for investments

投資支出

(612.0)

(150.1)

Payment for investment management fees

投資管理費支出

(45.5)

(42.4)

Net cash used in investing activities

投資活動現金流出淨額

(66.8)

(1,322.5)

Cash used in financing activity

融資活動現金流出

Repayment of loans from the Government

償還政府貸款

(3.8)

(3.5)

Net decrease in cash and cash equivalents

現金及現金等價項目減少淨額

(391.3)

(715.2)

Cash and cash equivalents at 1 April

四月一日現金及現金等價項

目結存

2,220.5

2,935.7

Cash and cash equivalents at 31 March

三月三十一日現金及現金等

價項目結存

1,829.2

2,220.5

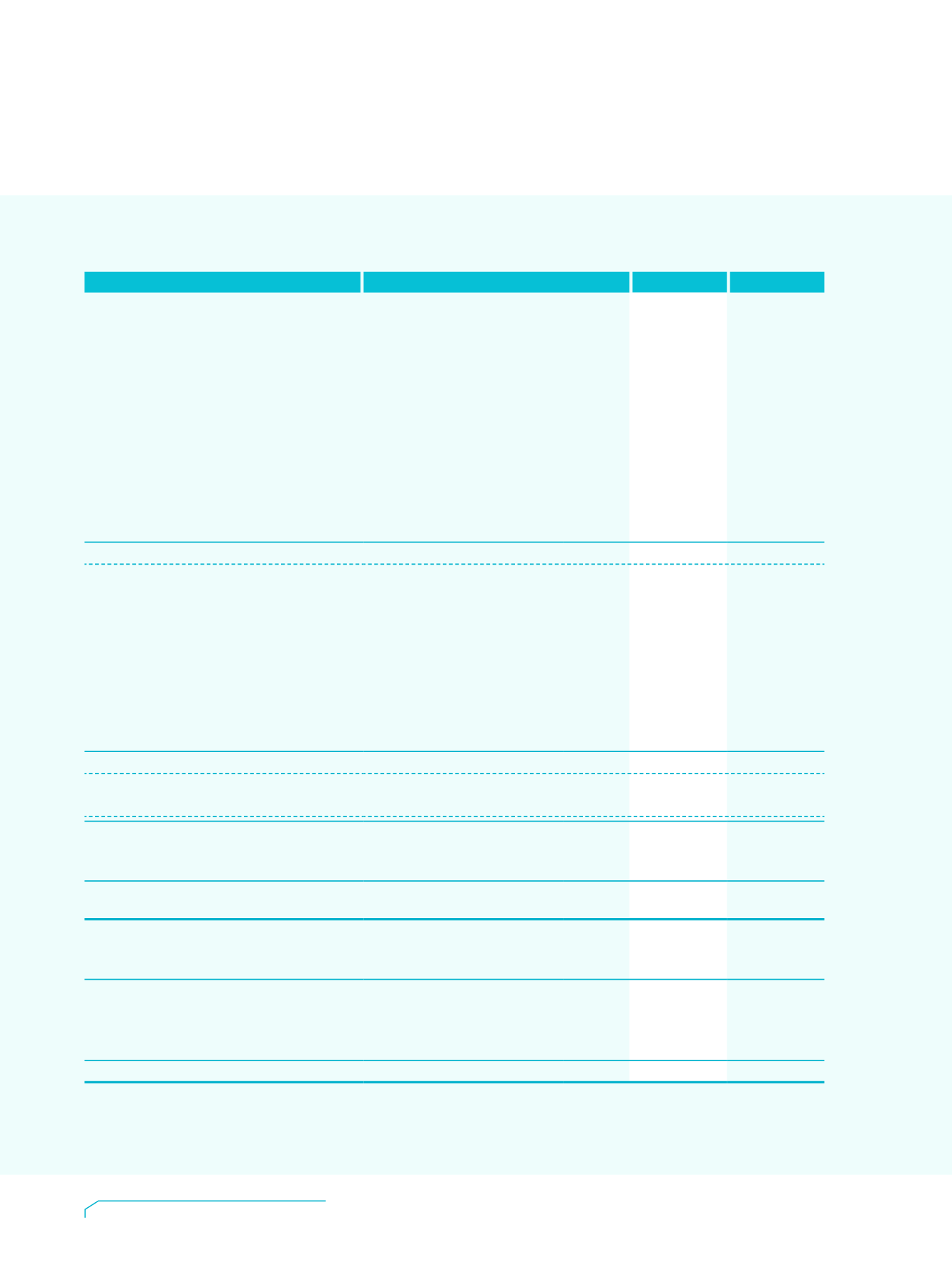

Analysis of the balances of cash and

cash equivalents

現金及現金等價項目結餘分析

Cash and bank balances

現金及銀行存款

1,829.2

2,220.5

Analysis of cash and bank balances

現金及銀行結餘分析

Balances of cash and cash equivalents

現金及現金等價項目結餘

1,829.2

2,220.5

Time deposits with maturity of more than

three months

超過三個月到期的定期存款

3,978.1

4,595.7

5,807.3

6,816.2

第

109

至第

153

頁的附註屬本財務報表的一部分。

The notes on pages 109 to 153 form part of these financial statements.