125

࠰

ಥ

܊ג

ึ

2014

ϋϋజ

Notes to the Financial Statements

ৌਕజ

ڝڌ

ൗ

F I NANC I A L S T A T EMENT S

財務報表

5 Financial risk management objectives and policies

(continued)

(c) Market risk

(continued)

(i) Foreign exchange risk

(continued)

5

財務風險管理目標及政策

(續)

(c)

市場風險

(續)

(i)

外幣對換風險

(續)

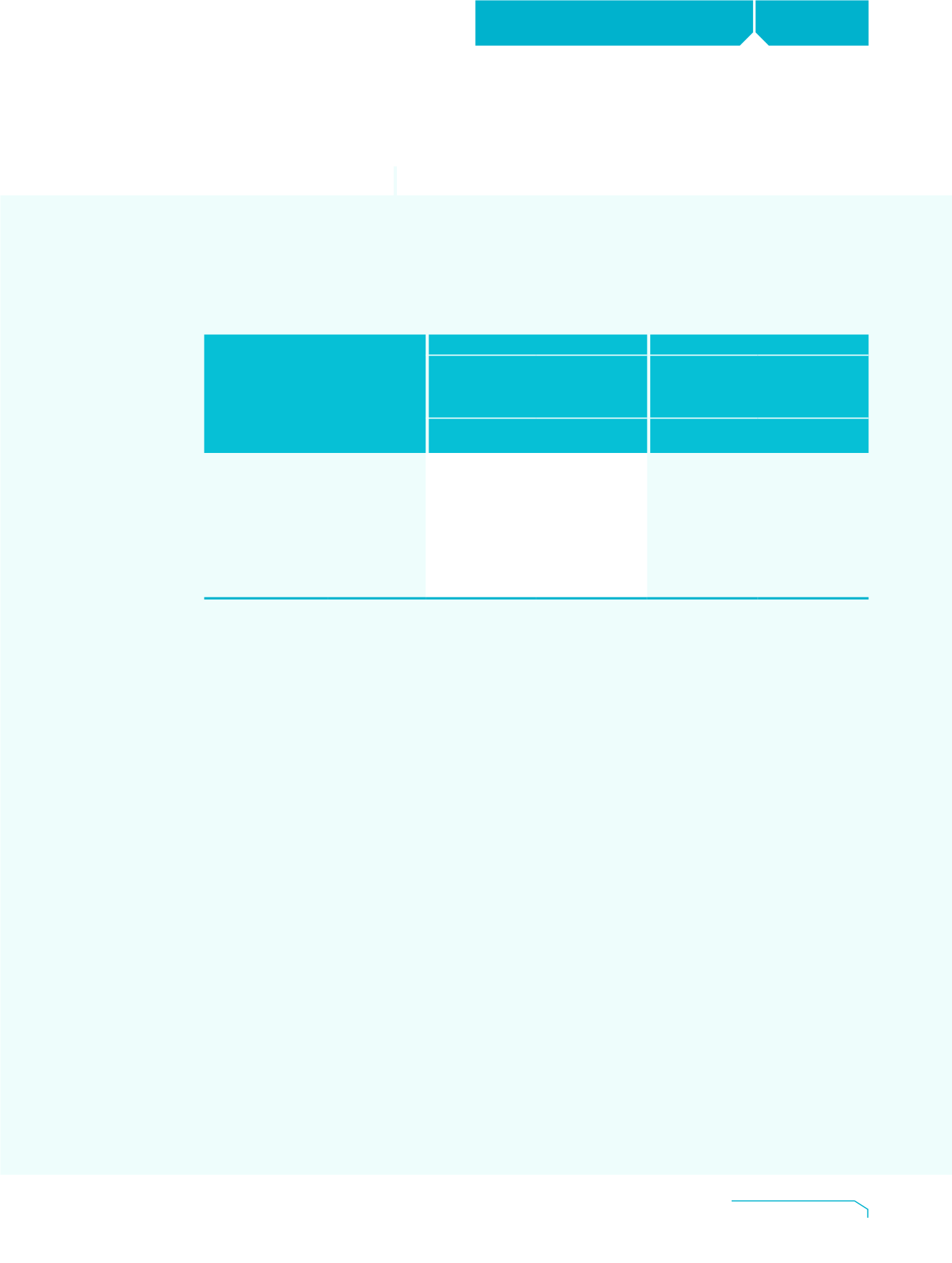

2014

2013

Currency

strengthened/

weakened by

升值或貶值

Effect on surplus

for the year

對本年盈餘

的影響

Currency

strengthened/

weakened by

升值或貶值

Effect on surplus

for the year

對本年盈餘

的影響

(in HK$ Million)

(

港幣百萬元

)

(in HK$ Million)

(

港幣百萬元

)

Renminbi

人民幣

1%

38.4

1%

42.3

Euro

歐羅

1%

13.9

1%

11.4

Japanese Yen

日元

1%

3.7

1%

5.9

Pound Sterling

英磅

1%

5.9

1%

3.3

Other currencies

其他貨幣

1%

11.3

1%

9.2

(ii) Price risk

The Housing Society is exposed to price risk arising from equity

and debt securities. This risk is controlled and monitored by

asset allocation limit.

At the end of the reporting period, it is estimated that an

increase/decrease of 1% (2013: 1%) in the market prices of

the equity and debt securities, with all other variables held

constant, would have increased/decreased the Housing

Society’s surplus by approximately HK$151.1 million (2013:

HK$145.5 million).

The sensitivity analysis above assumes that the changes in the

market prices of the equity and debt securities or other relevant

risk variables had occurred at the end of reporting period and

had been applied to re-measure those equity and debt

securities held by the Housing Society which expose the

Housing Society to price risk at the end of reporting period.

(ii)

價格風險

房屋協會面對價格風險是由股

本和債務證券,此風險是由資

產分配限額來監控的。

於報告期末,預料股本和債

務證券所連繫之投資市場價

格百分之一之上升 /下跌(二

零一三年:百分之一)所有

其 他 變 數 保 持 不 變), 估 計

房屋協會的盈餘會增加或減

少約港幣一億五千一百一十

萬 元(二 零 一 三 年: 約 港 幣

一億四千五百五十萬元)。

上述敏感度分析乃假設股本和

債務證券之投資市場價格或其

他相關風險變數於報告期末已

出現變動,並已應用於重新計

量房屋協會於報告期末所持有

並使房屋協會面對股票價格風

險之股本和債務證券。