133

࠰

ಥ

܊ג

ึ

2014

ϋϋజ

Notes to the Financial Statements

ৌਕజ

ڝڌ

ൗ

F I NANC I A L S T A T EMENT S

財務報表

11

投資物業

(續)

上述數字已包括位於香港的批租土地。

正在發展中的批租土地以中期租約持

有,而竣工 /購買物業的批租土地

包括:

11 Investment properties

(continued)

The above figures include leasehold land situated in Hong Kong. The

leasehold land under development is held under a medium-term lease

while the leasehold land for completed/purchased properties

comprises:

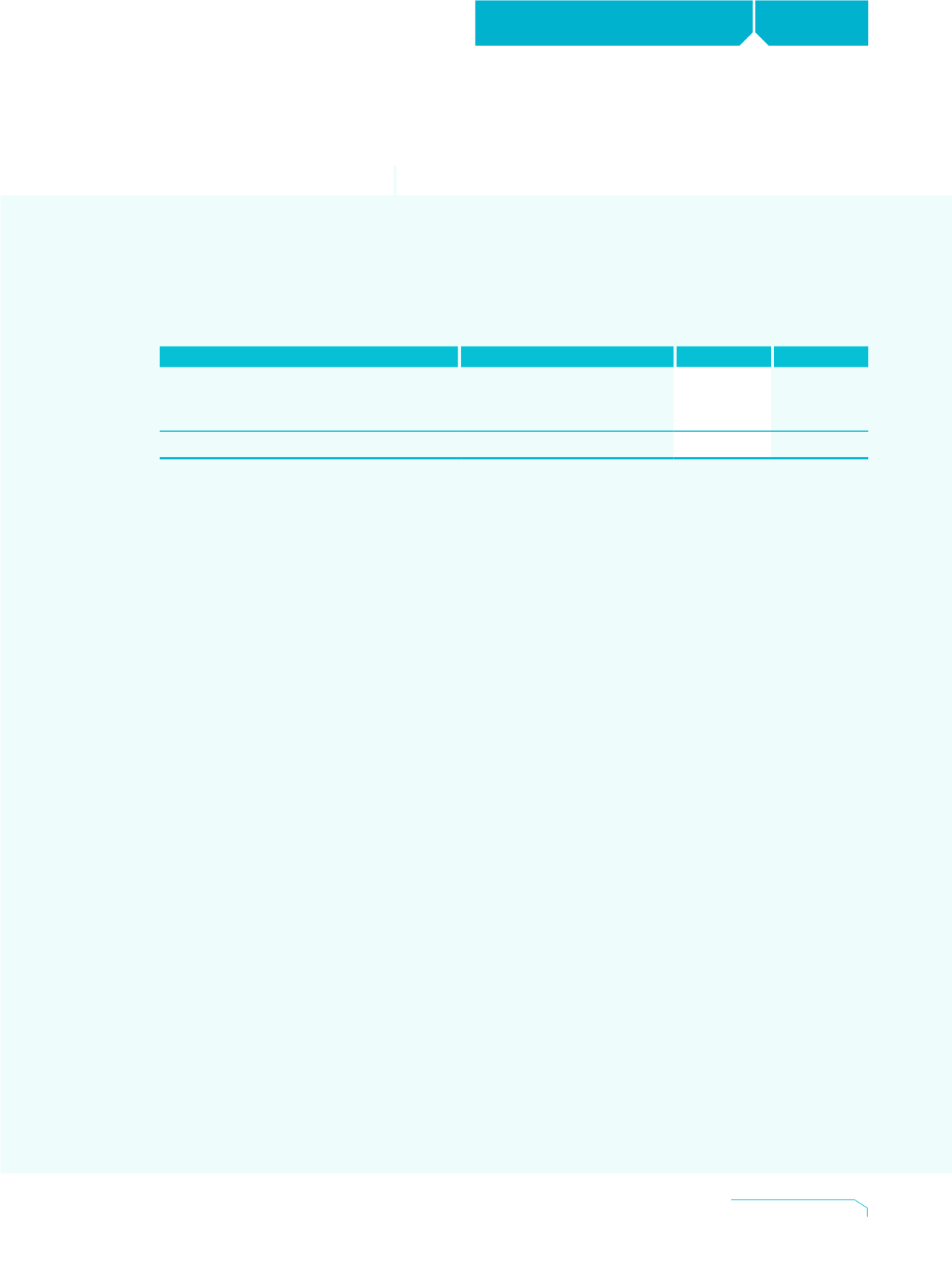

(in HK$Million)

(港幣百萬元)

2014

2013

Long lease (over 50 years)

長期契約(多於五十年)

1,273.4

1,274.8

Medium-term lease (10 to 50 years)

中期契約(十至五十年)

1,492.6

1,493.1

2,766.0

2,767.9

(a) Fair values

The Housing Society’s investment properties comprises (i) rental

estates built on land granted by the Government, and (ii)

commercial premises for long term investment purpose.

For rental estates with carrying value of HK$5,218.1 million (2013:

HK$4,920.2 million), the Government has included in the land

grant terms and conditions governing the sale and rental of the

properties. The fair values of the properties cannot be reliably

assessed because (i) the Government may or may not consider

giving approval for the Housing Society to sell any or all of its rental

estates; (ii) there are no comparable market transactions to provide

references; and (iii) concessionary rents are charged to tenants of

the public rental estates or tenants are age-restricted.

(a)

公允價值

房屋協會的投資物業包括

( i )

在政府

批出的土地上興建的出租屋邨及

(ii)

作長期投資為目的之商業樓宇。

政府在批出土地作興建出租屋邨

時,已加入限制此等物業出售及租

賃的特定條文。這些總值為港幣

五十二億一千八百一十萬元(二零

一三年:港幣四十九億二千零二十

萬元)的投資物業,其公允價值因

以下因素而不能可靠地估計:

( i )

政

府可能不會批准房屋協會出售其任

何或全部出租物業;

(ii)

沒有可用作

比較的市場交易;

( i i i )

公共屋邨租

客只須付出優惠租金或租客有年齡

限制。