Page 219 - Hong Kong Housing Society Annual Report 2024/25

P. 219

AUDITED FINANCIAL STATEMENTS 已審核財務報表

NOTES TO THE FINANCIAL STATEMENT 財務報表附註

5. Financial risk management objectives and 5. 財務風險管理目標及政策 (續)

policies (continued)

(a) Credit risk (continued) (a) 信貸風險 (續)

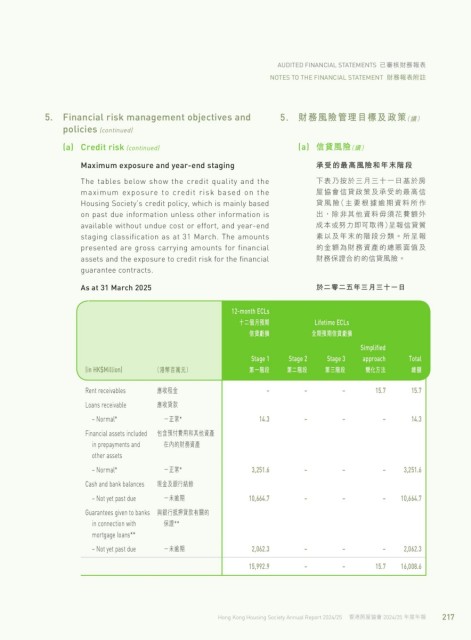

Maximum exposure and year-end staging 承受的最高風險和年末階段

The tables below show the credit quality and the 下表乃按於三月三十一日基於房

maximum exposure to credit risk based on the 屋協會信貸政策及承受的最高信

Housing Society’s credit policy, which is mainly based 貸風險(主要根據逾期資料所作

on past due information unless other information is 出,除非其他資料毋須花費額外

available without undue cost or effort, and year-end 成本或努力即可取得)呈報信貸質

staging classification as at 31 March. The amounts 素以及年末的階段分類。所呈報

presented are gross carrying amounts for financial 的金額為財務資產的總賬面值及

assets and the exposure to credit risk for the financial 財務保證合約的信貸風險。

guarantee contracts.

As at 31 March 2025 於二零二五年三月三十一日

12-month ECLs

十二個月預期 Lifetime ECLs

信貸虧損 全期預期信貸虧損

Simplified

Stage 1 Stage 2 Stage 3 approach Total

(in HK$Million) (港幣百萬元) 第一階段 第二階段 第三階段 簡化方法 總額

Rent receivables 應收租金 – – – 15.7 15.7

Loans receivable 應收貸款

– Normal* -正常* 14.3 – – – 14.3

Financial assets included 包含預付費用和其他資產

in prepayments and 在內的財務資產

other assets

– Normal* -正常* 3,251.6 – – – 3,251.6

Cash and bank balances 現金及銀行結餘

– Not yet past due -未逾期 10,664.7 – – – 10,664.7

Guarantees given to banks 與銀行抵押貸款有關的

in connection with 保證**

mortgage loans**

– Not yet past due -未逾期 2,062.3 – – – 2,062.3

15,992.9 – – 15.7 16,008.6

Hong Kong Housing Society Annual Report 2024/25 香港房屋協會 2024/25 年度年報 217