Page 224 - Hong Kong Housing Society Annual Report 2024/25

P. 224

5. Financial risk management objectives and 5. 財務風險管理目標及政策 (續)

policies (continued)

(c) Market risk (continued) (c) 市場風險 (續)

(ii) Price risk (ii) 價格風險

The Housing Society is exposed to price risk 房屋協會面對價格風險是由

arising from investment related financial 有關投資的財務資產及負債

assets and liabilities. This risk is controlled and 產生,此風險是由資產分配

monitored by asset allocation limit. 限額來監控的。

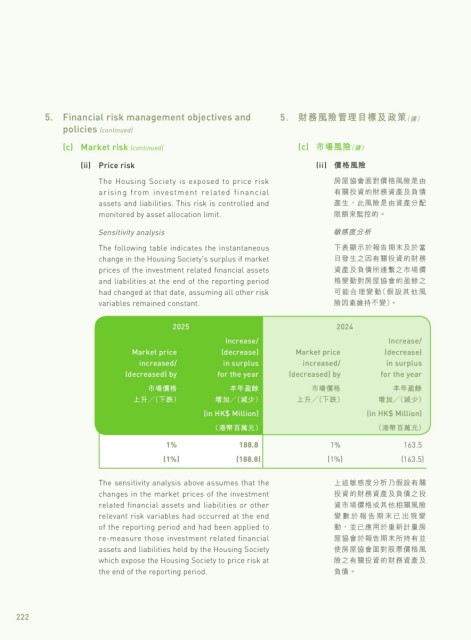

Sensitivity analysis 敏感度分析

The following table indicates the instantaneous 下表顯示於報告期末及於當

change in the Housing Society’s surplus if market 日發生之因有關投資的財務

prices of the investment related financial assets 資產及負債所連繫之市場價

and liabilities at the end of the reporting period 格變動對房屋協會的盈餘之

had changed at that date, assuming all other risk 可能合理變動(假設其他風

variables remained constant. 險因素維持不變)。

2025 2024

Increase/ Increase/

Market price (decrease) Market price (decrease)

increased/ in surplus increased/ in surplus

(decreased) by for the year (decreased) by for the year

市場價格 本年盈餘 市場價格 本年盈餘

上升╱(下跌) 增加╱(減少) 上升╱(下跌) 增加╱(減少)

(in HK$ Million) (in HK$ Million)

(港幣百萬元) (港幣百萬元)

1% 188.8 1% 163.5

(1%) (188.8) (1%) (163.5)

The sensitivity analysis above assumes that the 上述敏感度分析乃假設有關

changes in the market prices of the investment 投資的財務資產及負債之投

related financial assets and liabilities or other 資市場價格或其他相關風險

relevant risk variables had occurred at the end 變數於報告期末已出現變

of the reporting period and had been applied to 動,並已應用於重新計量房

re-measure those investment related financial 屋協會於報告期末所持有並

assets and liabilities held by the Housing Society 使房屋協會面對股票價格風

which expose the Housing Society to price risk at 險之有關投資的財務資產及

the end of the reporting period. 負債。

222