Page 220 - Hong Kong Housing Society Annual Report 2024/25

P. 220

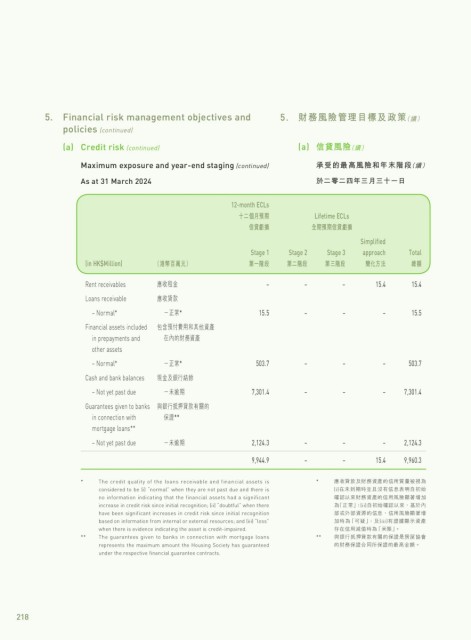

5. Financial risk management objectives and 5. 財務風險管理目標及政策 (續)

policies (continued)

(a) Credit risk (continued) (a) 信貸風險 (續)

Maximum exposure and year-end staging (continued) 承受的最高風險和年末階段 (續)

As at 31 March 2024 於二零二四年三月三十一日

12-month ECLs

十二個月預期 Lifetime ECLs

信貸虧損 全期預期信貸虧損

Simplified

Stage 1 Stage 2 Stage 3 approach Total

(in HK$Million) (港幣百萬元) 第一階段 第二階段 第三階段 簡化方法 總額

Rent receivables 應收租金 – – – 15.4 15.4

Loans receivable 應收貸款

– Normal* -正常* 15.5 – – – 15.5

Financial assets included 包含預付費用和其他資產

in prepayments and 在內的財務資產

other assets

– Normal* -正常* 503.7 – – – 503.7

Cash and bank balances 現金及銀行結餘

– Not yet past due -未逾期 7,301.4 – – – 7,301.4

Guarantees given to banks 與銀行抵押貸款有關的

in connection with 保證**

mortgage loans**

– Not yet past due -未逾期 2,124.3 – – – 2,124.3

9,944.9 – – 15.4 9,960.3

* The credit quality of the loans receivable and financial assets is * 應收貸款及財務資產的信用質量被視為

considered to be (i) “normal” when they are not past due and there is (i)在未到期時並且沒有信息表明自初始

no information indicating that the financial assets had a significant 確認以來財務資產的信用風險顯著增加

increase in credit risk since initial recognition; (ii) “doubtful” when there 為「正常」;(ii)自初始確認以來,基於內

have been significant increases in credit risk since initial recognition 部或外部資源的信息,信用風險顯著增

based on information from internal or external resources; and (iii) “loss” 加時為「可疑」;及(iii)有證據顯示資產

when there is evidence indicating the asset is credit-impaired. 存在信用減值時為「呆賬」。

** The guarantees given to banks in connection with mortgage loans ** 與銀行抵押貸款有關的保證是房屋協會

represents the maximum amount the Housing Society has guaranteed 的財務保證合同所保證的最高金額。

under the respective financial guarantee contracts.

218