4

資本風險管理

房屋協會的資本主要是其自成立以來所

累積的盈餘。其資本管理的目的是要確

保房屋協會能持續經營並為香港社會提

供優質房屋及服務。

房屋協會的資金主要是由內部提供,因

此資本風險管理政策亦集中於如何為其

資金盈餘保值來達到上述資本管理的目

的。有關資金保值政策列於附註五內。

5

財務風險管理目標及政策

房屋協會之主要財務工具包括:

4 Capital risk management

The Housing Society’s capital comprises primarily the surplus

accumulated since its establishment and its objective when

managing capital is to ensure that the Housing Society will be able

to continue as a going concern so that it can continue to provide

quality housing and services for the Hong Kong community.

Given that the Housing Society’s funding is mainly raised internally,

the policies on capital risk management are therefore focused on

how to preserve the surplus funds in order to achieve the above

capital management objective. Related policies on preserving the

surplus funds are set out in Note 5.

5 Financial risk management objectives and policies

The Housing Society’s major financial instruments comprise

the followings:

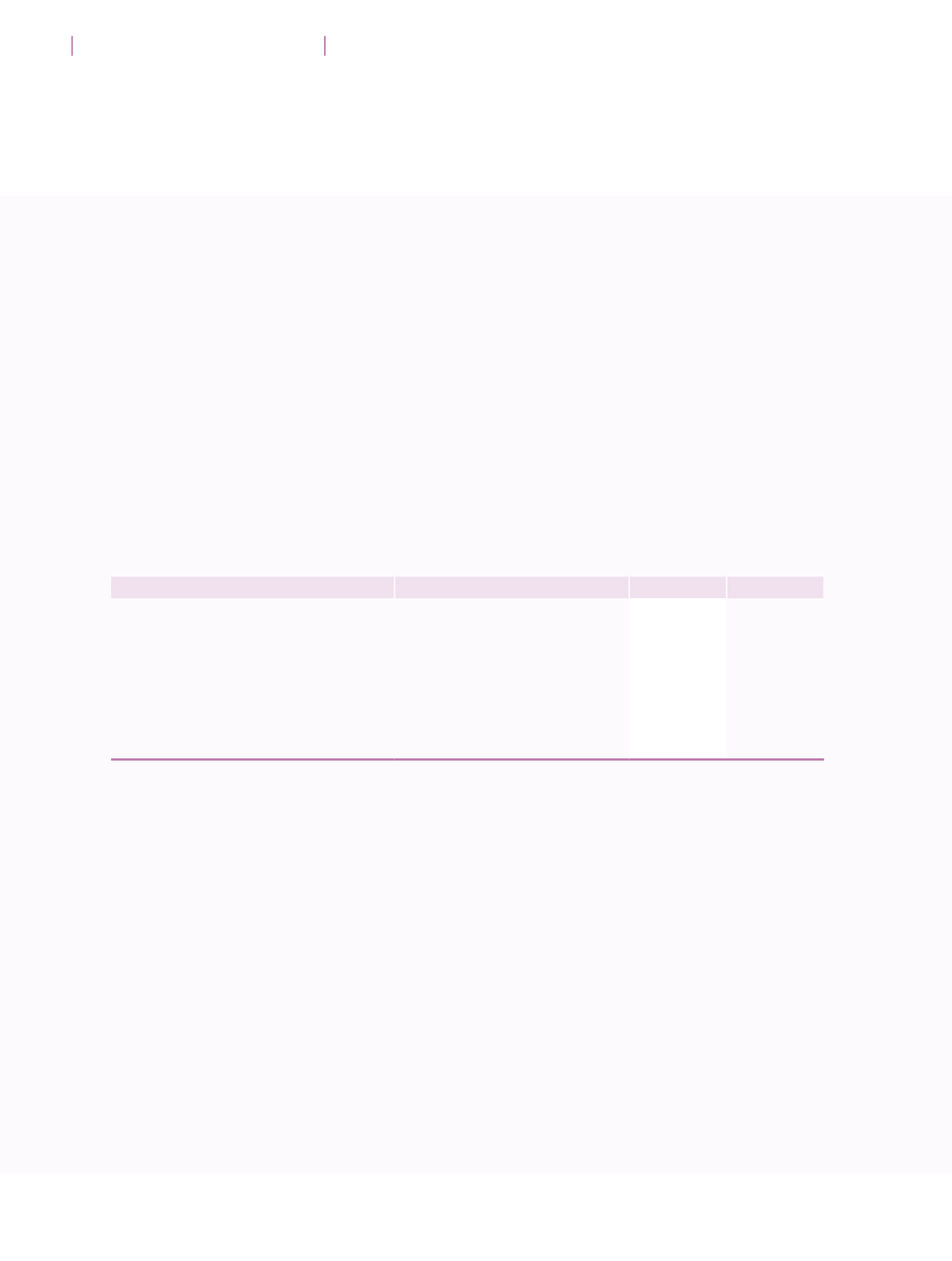

(in HK$Million)

(港幣百萬元)

2016

2015

Investment related financial assets

有關投資的財務資產

15,019.5

14,716.6

Investment related financial liabilities

有關投資的財務負債

(93.3)

(70.1)

Loans and receivables

(including cash and bank balances)

貸款及應收賬項

(包括現金及銀行結餘)

12,598.8

7,446.9

Financial liabilities at amortised cost

根據攤銷成本法入賬的財務負債

(1,547.5)

(1,141.0)

Loans from government

政府貸款

(50.2)

(53.7)

以上財務工具之詳情已於相關附註中作

出披露。該等財務工具之相關風險及減

輕此等風險之制度載列如下。管理層管

理及監察此等風險,以確保能即時及有

效地採取適當措施。

Details of the above financial instruments are disclosed in the

respective notes. The risks associated with these financial

instruments and the policies applied by the Housing Society to

mitigate these risks are set out below. Management monitors these

exposures to ensure appropriate measures are implemented in a

timely and effective manner.

Hong Kong Housing Society Annual Report 2016

128

Notes to the Financial Statements

財務報表附註

FINANCIAL STATEMENTS

財務報表