Hong Kong Housing Society Annual Report 2014

10

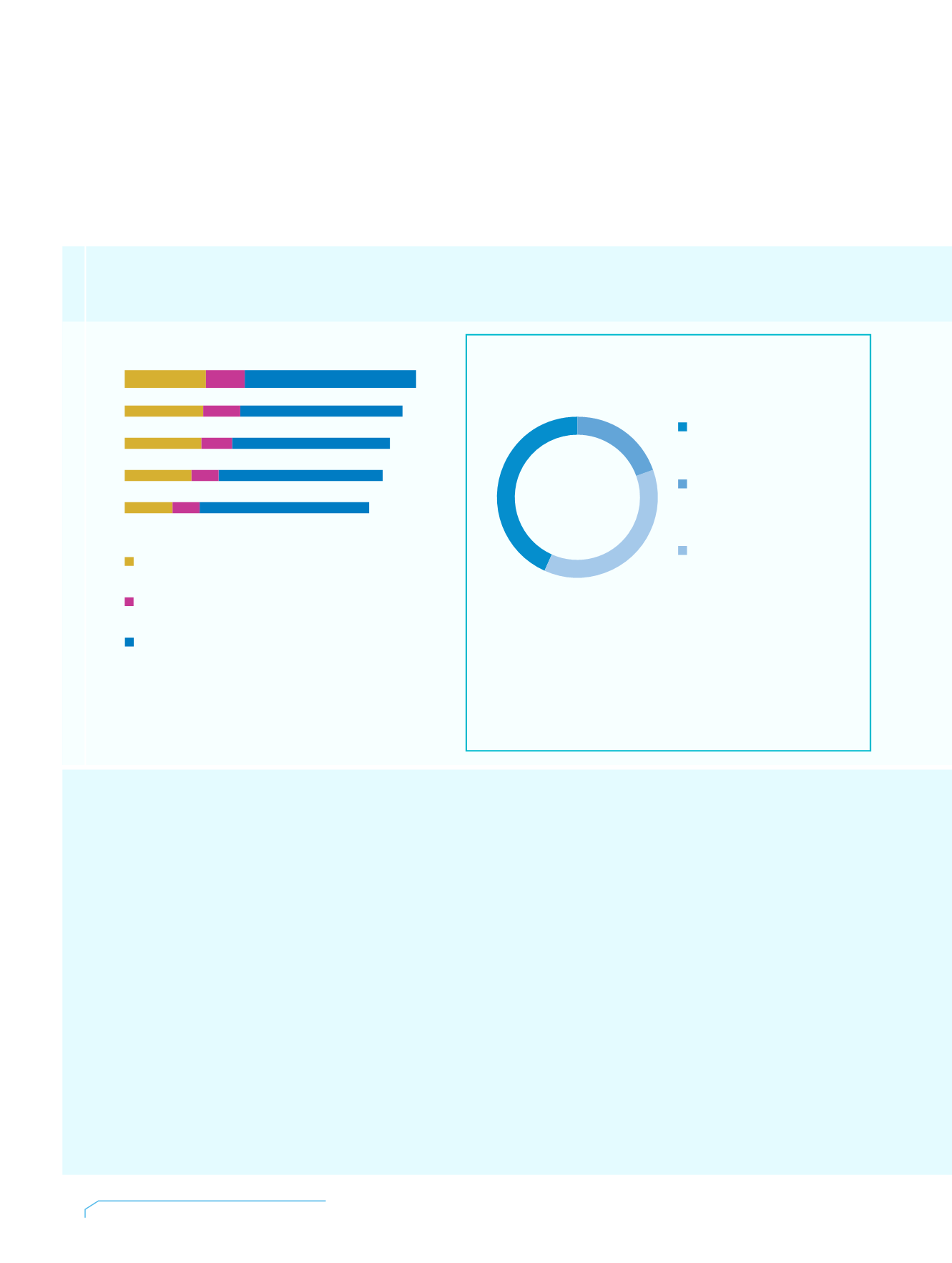

Projects under Planning and Committed Projects

規劃中及已落實的項目

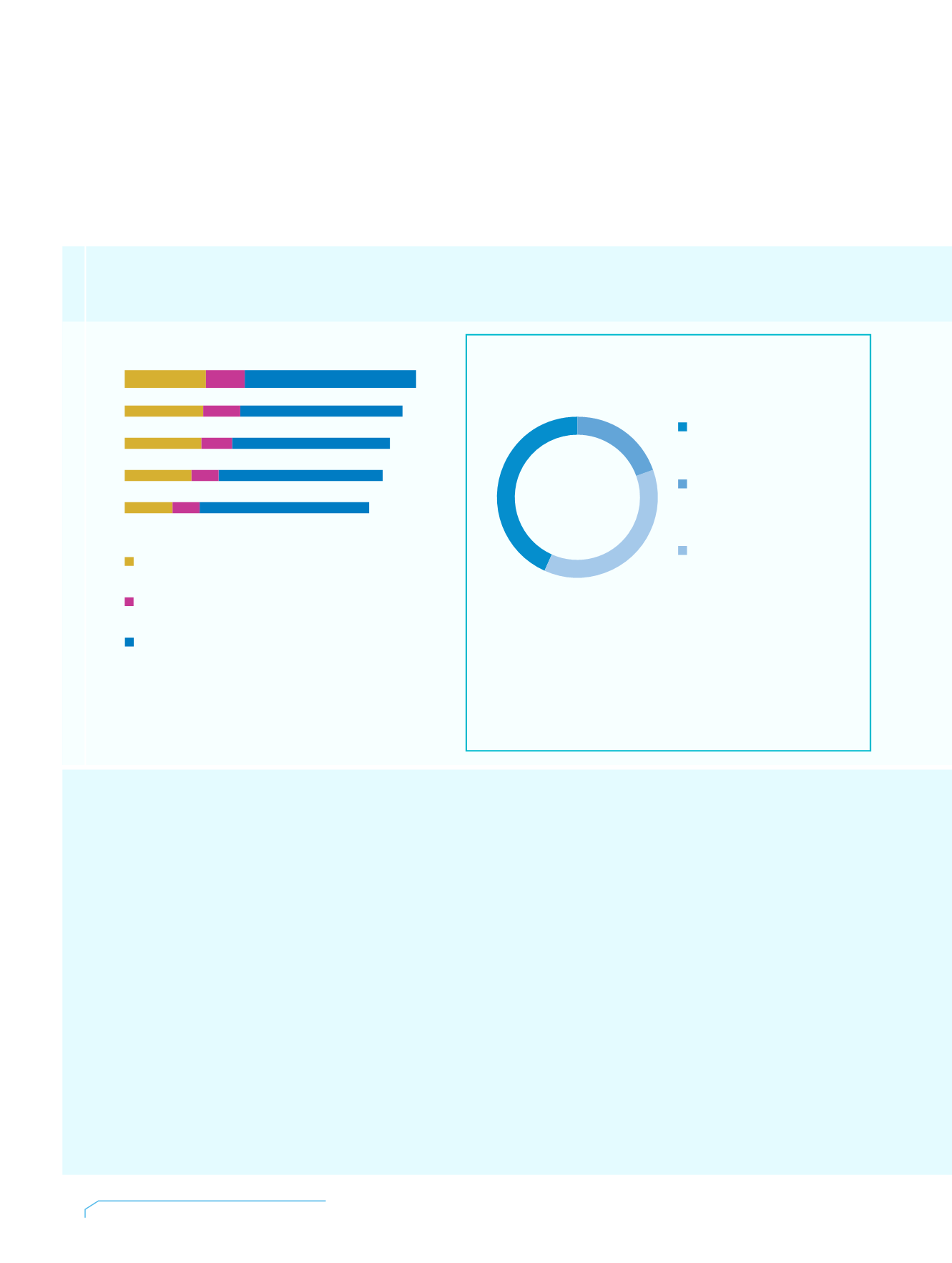

Net Assets Distribution

淨資產分佈

as at 31 March 2014

截至二零一四年三月三十一日止

32.3

30.8

29.4

28.6

27.1

2014

2013

2012

2011

2010

19

18

17.5

18.2

18.8

4.3

9

4.1

8.7

3.4

8.5

3

7.4

3

5.3

HK$ Billion

港幣十億元

HK$ Billion

港幣十億元

Year

年份

4.4 (20%)

Amount Contracted but not Provided

in the Financial Statements

已批出但未於財務報表顯示的金額

Properties for Sale

出售物業

8.3 (37%)

Amount Authorised but not Contracted

已授權但未批出的金額

Financial Assets and Others

財務資產及其他

22.4

Total

總數

Projects

項目

• Tanner Hill Project

丹拿山項目

• Two Rental Estate

Redevelopment Projects

兩個出租屋邨重建項目

• Five Urban Renewal Projects

五個市區重建項目

9.7 (43%)

Projects under Planning

規劃中的項目

Rental Properties

出租物業

• Two Subsidised Sale

Projects

兩個資助出售房屋項目

• New Sha Tau Kok Rural

Public Housing

新沙頭角郊區公共房屋

• ‘Ageing-in-Place’ Scheme/

Elderly Safe Living Scheme

「樂得耆所」計劃 /

「長者住安心」計劃

• Building Management and

Maintenance Schemes

各項樓宇管理維修計劃

Arising out of our involvement in urban renewal, from time to time, there

are Housing Society flats put onto the market. There, we see reasons to

sell the flats at market prices since we have paid market prices for the

site and the construction, and there are no income or asset restrictions

on the purchasers. In fact, our prices are never exorbitant, as the flats we

build are designed to be ‘practical but not extravagant’.

We run our commercial operations according to commercial principles

and do not attempt to tamper with market dynamics. The objective is to

achieve a reasonable return.

房協因為參與市區重建工作的原故,因而不

時有樓盤推出市場。但由於以市價取得地皮

及進行發展,對買家亦不設任何收入及資產

限制,所以單位應按市場水平定價。事實

上,我們興建的單位是以「實而不華」的概

念而設計,因此定價不會偏高。

在商業項目方面,我們根據市場動向以商業

原則營運,目的是要取得合理的回報。