Page 250 - Hong Kong Housing Society Annual Report 2024/25

P. 250

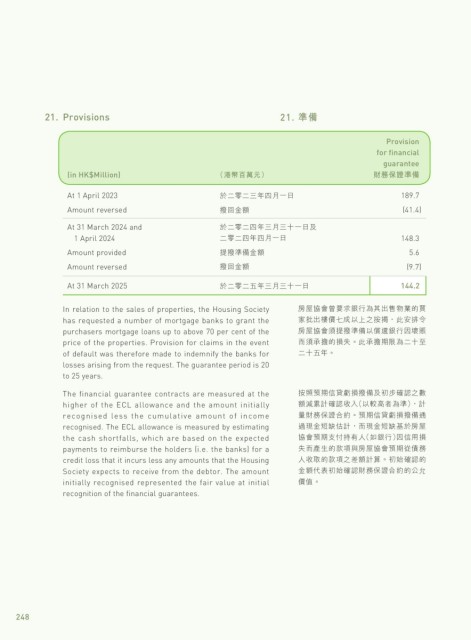

21. Provisions 21. 準備

Provision

for financial

guarantee

(in HK$Million) (港幣百萬元) 財務保證準備

At 1 April 2023 於二零二三年四月一日 189.7

Amount reversed 撥回金額 (41.4)

At 31 March 2024 and 於二零二四年三月三十一日及

1 April 2024 二零二四年四月一日 148.3

Amount provided 提撥準備金額 5.6

Amount reversed 撥回金額 (9.7)

At 31 March 2025 於二零二五年三月三十一日 144.2

In relation to the sales of properties, the Housing Society 房屋協會曾要求銀行為其出售物業的買

has requested a number of mortgage banks to grant the 家批出樓價七成以上之按揭,此安排令

purchasers mortgage loans up to above 70 per cent of the 房屋協會須提撥準備以償還銀行因壞賬

price of the properties. Provision for claims in the event 而須承擔的損失。此承擔期限為二十至

of default was therefore made to indemnify the banks for 二十五年。

losses arising from the request. The guarantee period is 20

to 25 years.

The financial guarantee contracts are measured at the 按照預期信貸虧損撥備及初步確認之數

higher of the ECL allowance and the amount initially 額減累計確認收入(以較高者為準),計

recognised less the cumulative amount of income 量財務保證合約。預期信貸虧損撥備通

recognised. The ECL allowance is measured by estimating 過現金短缺估計,而現金短缺基於房屋

the cash shortfalls, which are based on the expected 協會預期支付持有人(如銀行)因信用損

payments to reimburse the holders (i.e. the banks) for a 失而產生的款項與房屋協會預期從債務

credit loss that it incurs less any amounts that the Housing 人收取的款項之差額計算。初始確認的

Society expects to receive from the debtor. The amount 金額代表初始確認財務保證合約的公允

initially recognised represented the fair value at initial 價值。

recognition of the financial guarantees.

248