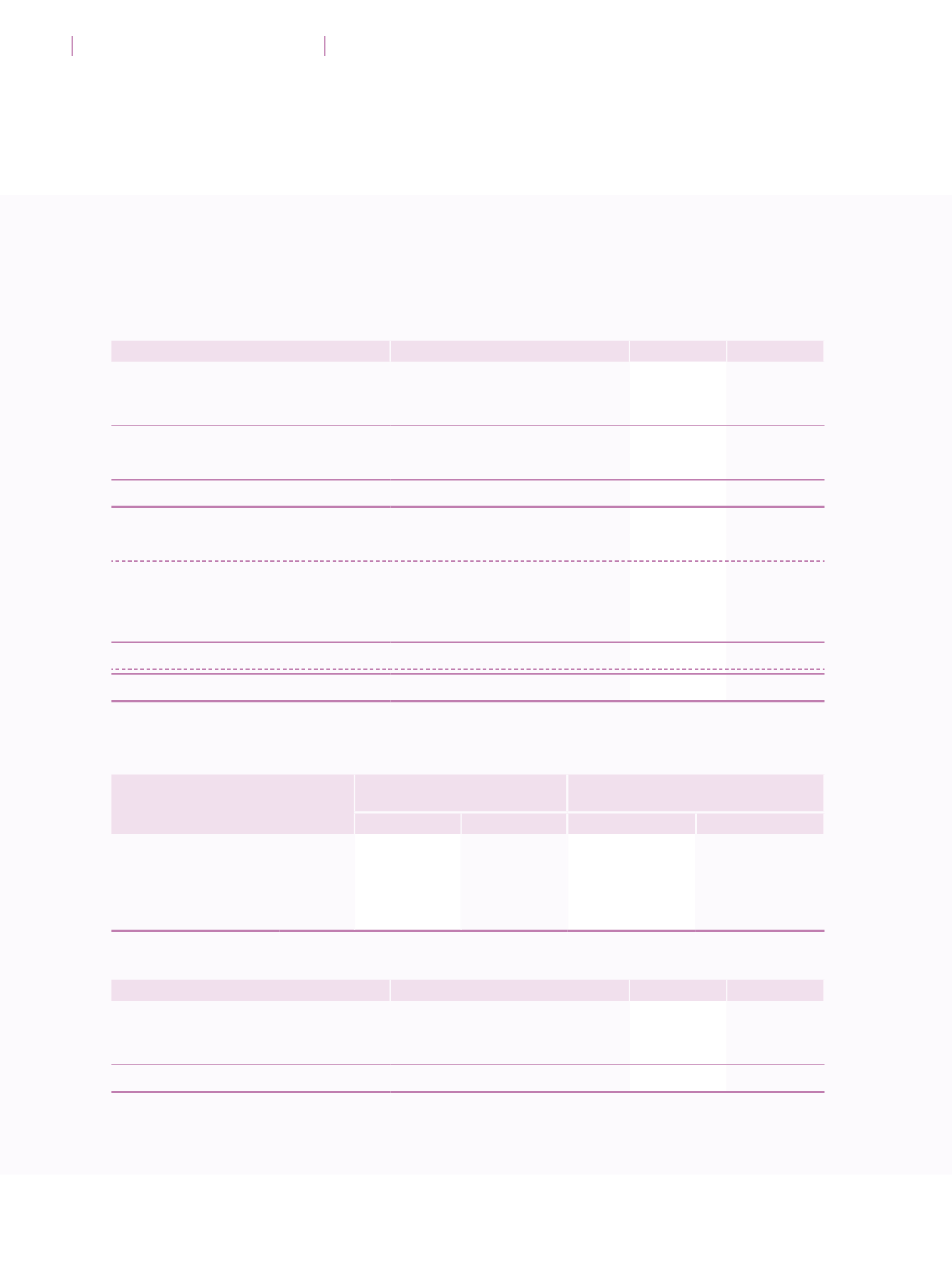

14

應收貸款

應收貸款主要是指為樓宇買家所提供的第

二按揭貸款,或在樓宇管理維修綜合計劃

中,為業主提供的免息無抵押貸款。所有

有抵押的貸款是以住宅物業作押。

14 Loans receivable

Loans receivable represents mainly the second mortgage loans

granted to the flat buyers and unsecured loans granted to home

owners under the Building Management and Maintenance Scheme.

All the secured loans are secured by residential properties.

(in HK$Million)

(港幣百萬元)

2016

2015

Secured mortgage loans

有抵押品按揭貸款

314.1

147.0

Unsecured loans

無抵押品貸款

31.3

19.4

345.4

166.4

Less: impairment losses

減:減值損失

(3.2)

(4.2)

342.2

162.2

Representing:

上列數目代表:

Due within one year

一年內到期

7.5

6.1

Due after 1 year, but within 2 years

一年至二年內到期

13.8

6.8

Due after 2 years, but within 5 years

二年至五年內到期

44.3

25.0

Due after 5 years

五年以後到期

276.6

124.3

Total due after 1 year

一年以後到期總額

334.7

156.1

342.2

162.2

有關應收貸款的利率現列如下:

Interest rates applicable to the above loans receivable are set

out below:

Secured mortgage loans

有抵押品按揭貸款

Unsecured loans

無抵押品貸款

2016

2015

2016

2015

Contractual interest rate

合約利率

Prime rate

最優惠利率

Prime rate

最優惠利率

0%to Prime rate

0%

至最優惠利率

0% to Prime rate

0%

至最優惠利率

Effective interest rate

實質利率

Prime rate

最優惠利率

Prime rate

最優惠利率

9.7%

10.4%

(in HK$Million)

(港幣百萬元)

2016

2015

At 1 April

四月一日

4.2

3.0

(Reversed)/provided

(撥回)/計提

(1.0)

1.2

At 31 March

三月三十一日

3.2

4.2

減值損失準備的變動如下:

The movements in allowance for impairment losses were as follows:

Hong Kong Housing Society Annual Report 2016

142

Notes to the Financial Statements

財務報表附註

FINANCIAL STATEMENTS

財務報表