14

應收貸款

(續)

當借款人未能償還六個月以上的定額還

款時,該貸款的減值損失會被個別評

估。於報告期末,被個別評估減值的貸

款賬面值為港幣三百二十萬元(二零一五

年:港幣四百二十萬元),其減值損失為

港幣三百二十萬元(二零一五年:港幣

四百二十萬元)。

其後,當房屋協會認定個別評估貸款並

無客觀減值證據,此等貸款(無論重大

與否)將與其他有相似信貸風險的貸款

歸類,其貸款的減值準備會按此類貸款

者過往在利息或本金拖欠情況作出綜合

評估。

於二零一五年及二零一六年三月三十一

日,房屋協會並沒有重大過期還款而未

減值的貸款。而沒有逾期還款或減值損

失的貸款,可被視為良好信貸,因大部

分的貸款是以住宅物業作抵押和有良好

還款記錄。在本年度,該等貸款的信貸

質素是沒有重大的轉變。

15

作出售用途的發展中物業

14 Loans receivable

(continued)

Impairment of the above loans is assessed individually when any

borrowers are unable to settle overdue installments for more

than six months. At the end of the reporting period, the carrying

amount of these individually assessed loans was HK$3.2 million

(2015: HK$4.2 million) and impairment loss of the loans was

HK$3.2 million (2015: HK$4.2 million).

Thereafter, if the Housing Society determines that no objective

evidence of impairment exists for an individually assessed loans

receivable, whether significant or not, it includes the asset in a

group of loans receivable with similar credit risk characteristics

with reference to borrowers’ historical default in interest or

principal payment and collectively assesses them for impairment.

At 31 March 2015 and 2016, the carrying values of loans that are

past due but not impaired are insignificant. For loans that are

neither past due nor impaired, their credit quality is considered

good since majority of the loans are secured by residential

properties and have good settlement history. During the year, there

has been no significant change in the credit quality.

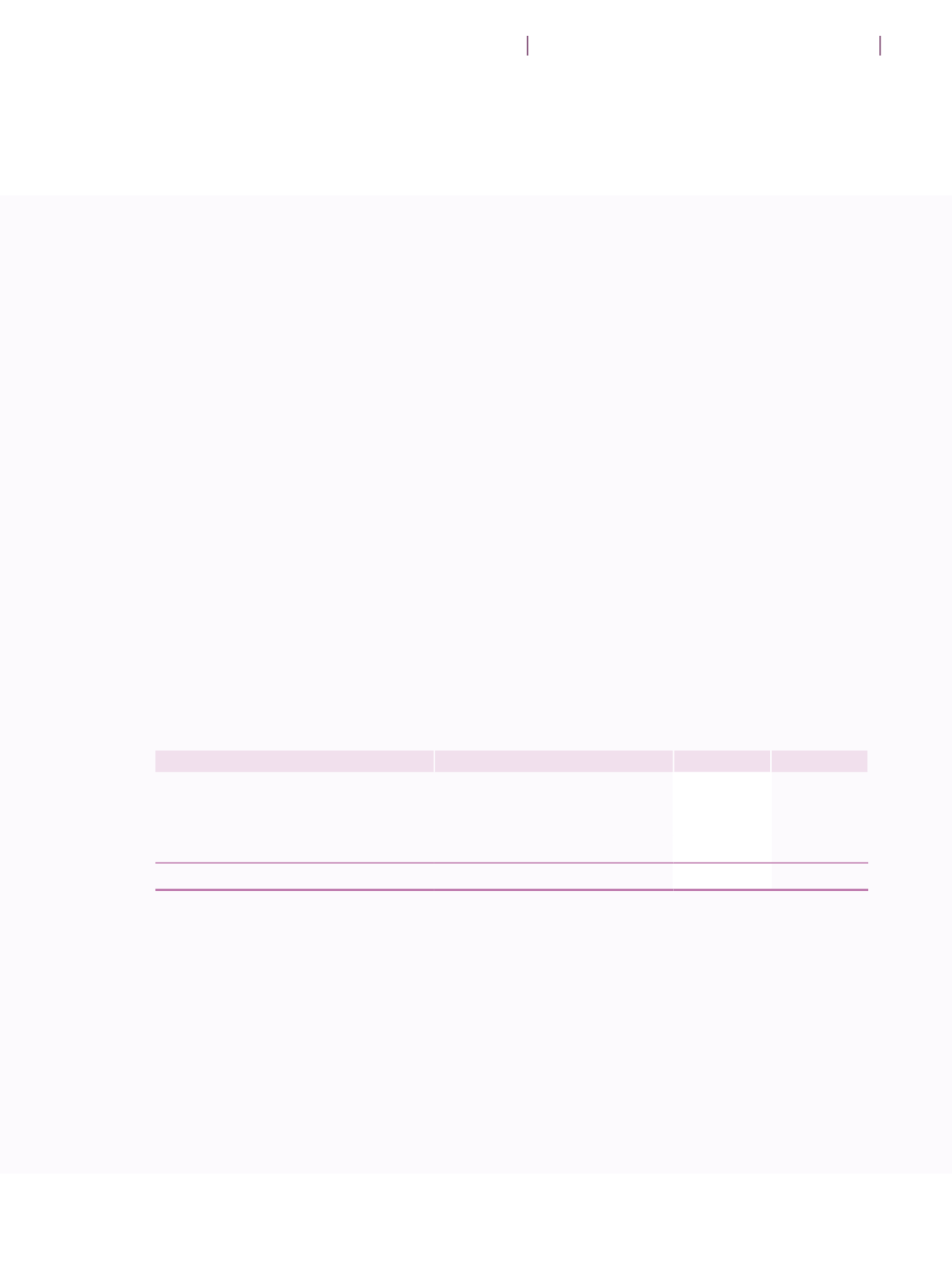

15 Properties under development for sale

(in HK$Million)

(港幣百萬元)

2016

2015

At 1 April

四月一日

5,815.7

4,219.5

Additions during the year

本年度增加

1,242.2

2,464.2

Transfer to housing inventories

轉至樓宇存貨

(3,338.0)

(868.0)

At 31 March

三月三十一日

3,719.9

5,815.7

在二零一六年三月三十一日,港幣

三十七億一千九百九十萬元(二零一五

年:港幣五十八億一千五百七十萬元)

中有港幣十三億三千八百萬元(二零

一五年:港幣二十七億九千零五十萬

元)預期會在報告期末後的十二個月以

外收回或確認為支出。

Out of HK$3,719.9 million (2015: HK$5,815.7 million) at 31 March

2016, the amount of HK$1,338.0 million (2015: HK$2,790.5

million) is expected to be recovered or recognised as expense after

more than 12 months from the end of the reporting period.

143

香港房屋協會

2016

年年報

Notes to the Financial Statements

財務報表附註