16

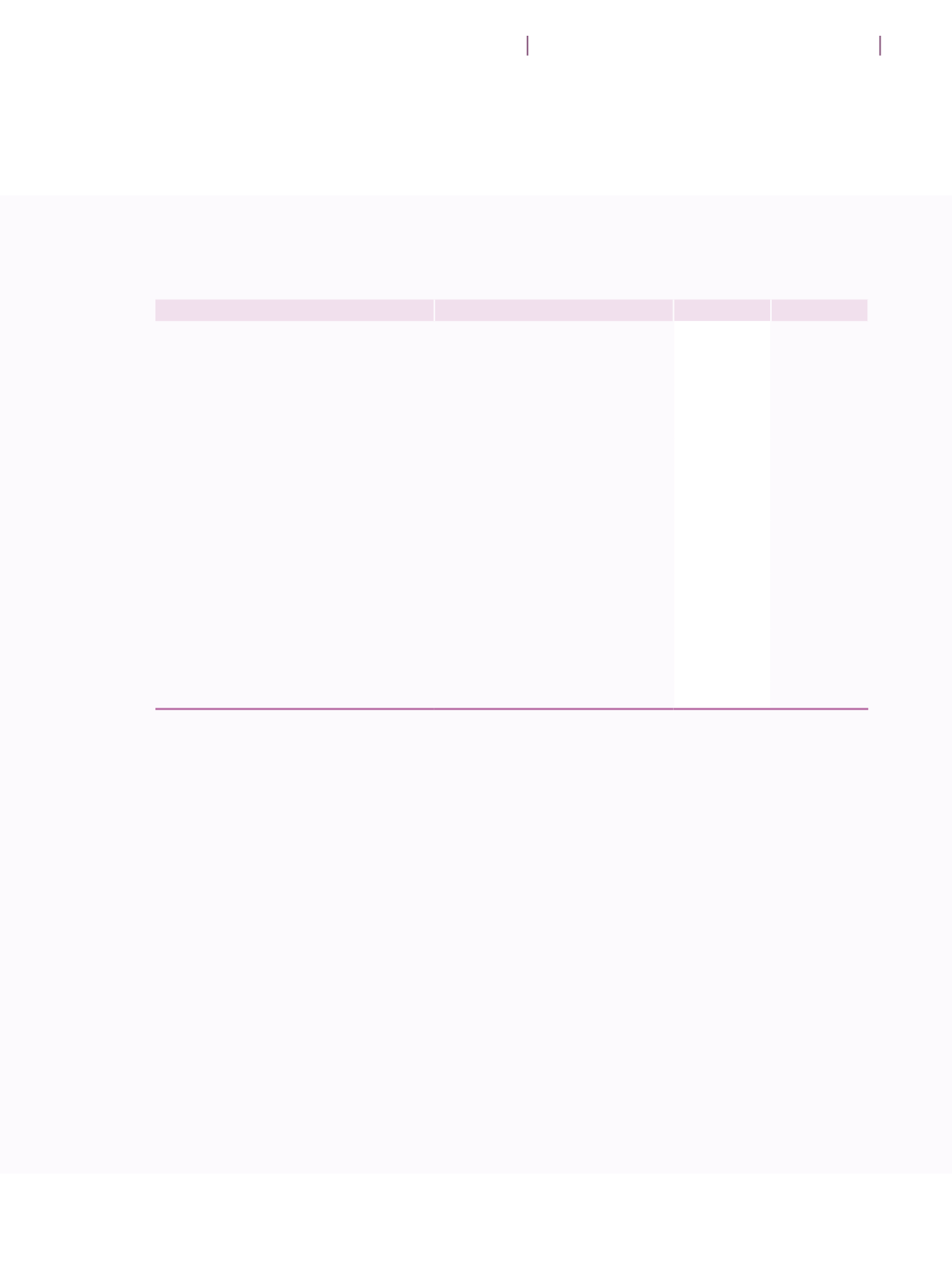

有關投資的財務資產及負債

(續)

下表提供按地區市場劃分之投資分析:

16 Investment related financial assets/liabilities

(continued)

The following table provides an analysis of the investments by

geographical market:

(in HK$Million)

(港幣百萬元)

2016

2015

Equity securities

股本證券

Hong Kong

香港

27%

30%

United States

美國

41%

37%

Europe

歐洲

25%

24%

Japan

日本

2%

2%

Others

其他

5%

7%

Debt securities

債務證券

United States

美國

47%

45%

Europe

歐洲

38%

39%

Japan

日本

10%

7%

Others

其他

5%

9%

Unit trusts

單位信託

Europe

歐洲

55%

74%

Others

其他

45%

26%

於報告期末,環球固定收益組合債券加

權平均到期收益率為

1.97%

(二零一五

年:

1.76%

)及其加權平均期限為

6.86

年(二零一五年:

6.66

年)。

有關投資財務負債,

46%

(二零一五

年:

36%

)於報告期末後三十天到期

交收。

At the end of the reporting period, the weighted average yield to

maturity rate of global fixed income is 1.97% (2015: 1.76%) and

weighted average duration is 6.86 years (2015: 6.66 years).

On investment related financial liabilities, 46% (2015: 36%) is due

for settlement within 30 days after the end of the reporting period.

145

香港房屋協會

2016

年年報

Notes to the Financial Statements

財務報表附註