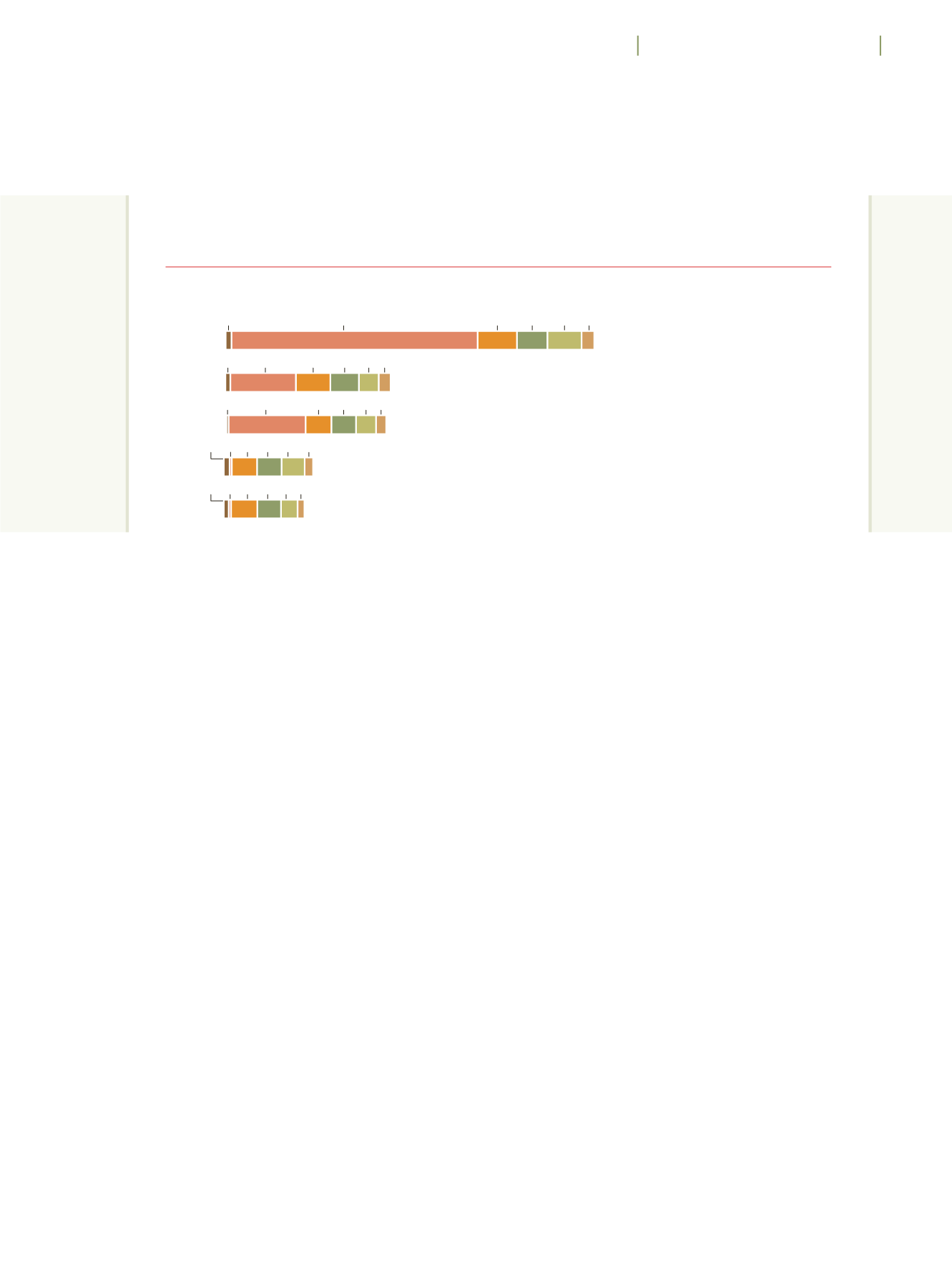

Year

年份

HK$ Million

港幣百萬元

Expenditure Distribution

支出分佈

as at 31 March 2016

截至二零一六年三月三十一日止

53

436

182

3,527

563

490

37

409

146

939

508

283

12

353

137

1,103

369

287

(44)

352

113

(13)

362

331

(32)

340

93

(15)

376

237

2011/12

2012/13

2013/14

2014/15

2015/16

■

Social Project Expenditures

社區項目支出

■

Property Development and

Related Costs

物業發展及相關成本

■

Property Leasing and

Management Expenses

物業租賃及管理支出

■

Staff Costs

員工成本

■

Assets Depreciation,

Impairment and Written off

資產折舊、減值及撇銷

■

Other Operating Costs

其他營運成本

5,251

2,261

1,101

999

2,322

73

香港房屋協會

2016

年年報

Given the unfavourable market conditions and volatility on the global

investment market, our securities investments recorded a loss of

HK$442 million for the year.

Expense Analysis

Total expenses went up to HK$5,251 million during the review

period, an increase of HK$2,929 million year-on-year. The increase

was mainly attributed to the rise in property development costs

related to Heya Delight, Heya Star and Greenview Villa, and an

impairment loss made this year for two investment properties under

development, namely the redevelopment of Ming Wah Dai Ha and a

new rental estate in Sha Tau Kok. Property leasing and management

expenses also went up with higher spending in cleaning and security

expenses because of the increase in minimum wages, day-to-day

maintenance of our ageing estates, and promotion and marketing

expenses for The Tanner Hill.

Financial Outlook and Management

Property Sales

Subsidised Sale Flats projects in the pipeline with a target to

attain breakeven

Property development for sale is one of the core businesses of the

Housing Society. Over the years, the Housing Society has developed

various housing schemes to help the people of Hong Kong fulfil their

home ownership aspirations. Affordable housing units were sold to

Financial Management

財務管理

由於市道欠佳,加上全球投資市場波動,我

們年內的證券投資錄得四億四千二百萬港元

的虧損。

支出分析

本年度的總支出增至五十二億五千一百萬

港元,按年增加二十九億二千九百萬港元。

增加主要是由於「喜盈」、「喜韻」及「綠悠

雅苑」的物業發展成本上漲,以及本年度就

兩項發展中的投資物業(即重建明華大廈及

沙頭角新出租屋邨)作出減值虧損。由於最

低工資上調令清潔及保安開支上升,加上

舊邨的日常維修,以及「雋悅」的推廣與營銷

支出,令物業租賃及管理開支亦有所增加。

財務前景及管理

物業銷售

籌劃中以達致收支平衡為目標的資助出售

房屋項目

發展出售物業為房協其中一項核心業務。

房協多年來先後發展過不同的房屋計劃,協

助香港市民實現置業願望。由過往的「住宅

發售計劃」及「夾心階層住屋計劃」,以至近