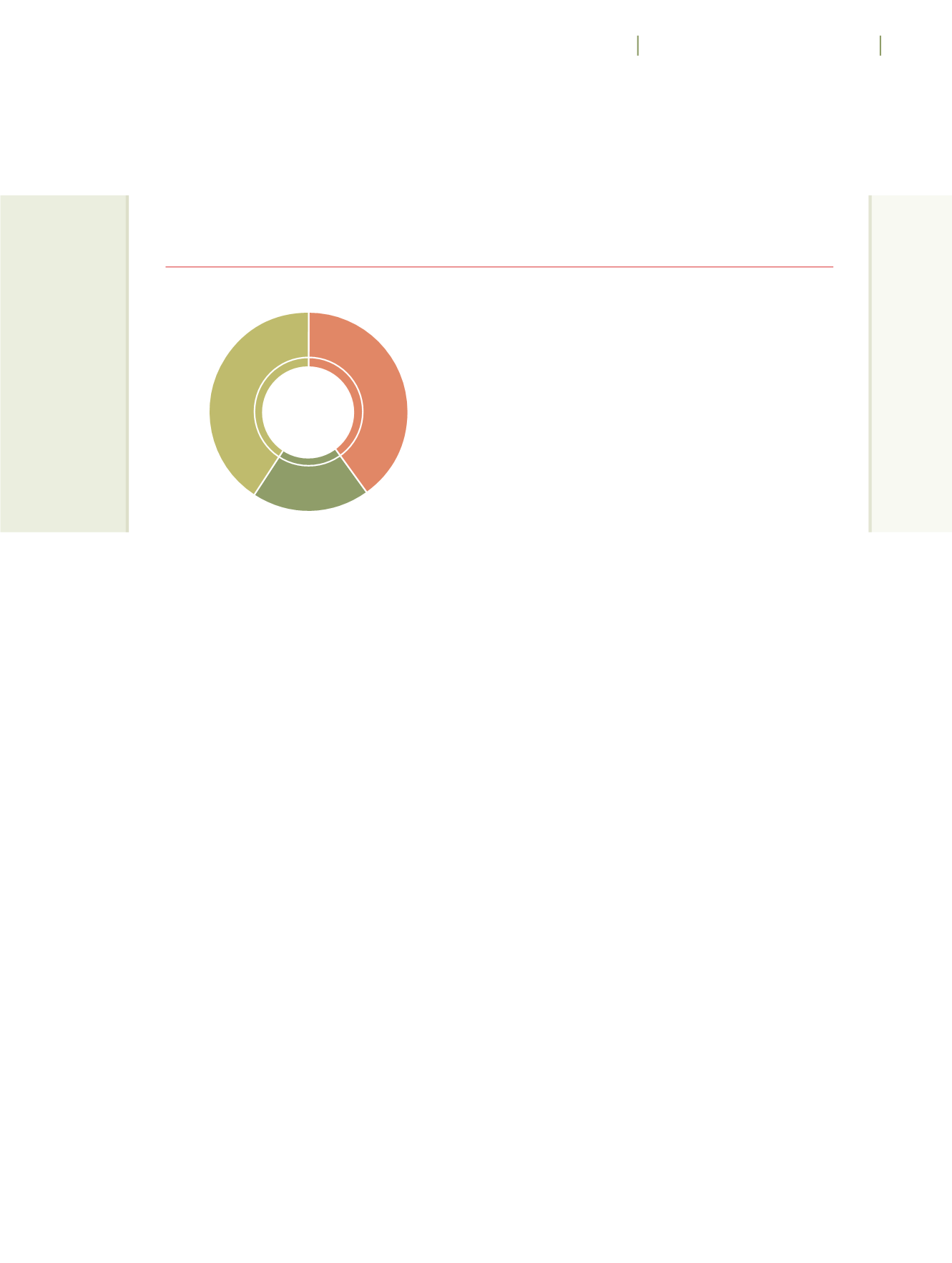

HK$ Billion

港幣十億元

Investment Portfolio

投資組合

as at 31 March 2016

截至二零一六年三月三十一日止

26.0

Total

總數

■

10.3 (40%)

長期

Long Term

For Redevelopment of Rental Estates

用於重建出租屋邨

■

4.9 (19%)

中期

Medium Term

Income Generated to Fund the Construction

of Subsidised Sale Flats Projects

收益用於興建資助出售房屋項目

Principle as a Reserve to Fund the

Redevelopment of Rental Estates

本金作為重建出租屋邨的儲備

■

10.8 (41%)

短期

Short Term

For On-going

Business Initiatives

用於進行中的業務計劃

Funding Strategy

資金策略

77

香港房屋協會

2016

年年報

Financial Management

財務管理

The long-term portfolio is used to fund the redevelopment of our

rental estates. As the objective is to catch up with construction cost

inflation in Hong Kong, the portfolio is fairly diversified and equity

biased. For the year ended 31 March 2016, it recorded a loss of

4.82%, outperforming the benchmark by 1.05%.

The medium-term portfolio is used to fund the construction of our

Subsidised Sale Flats projects. The portfolio is relatively low risk and

fixed-income biased. For the year ended 31 March 2016, it recorded

a gain of 0.33%, underperforming the benchmark by 0.49%.

As the objective of the short-term portfolio is to preserve capital and

ensure liquidity, we continued to manage the portfolio prudently by

placing the surplus cash into fixed deposits with a maturity of no more

than six months. For the year ended 31 March 2016, the short-term

portfolio achieved a return of 0.09%, underperforming the benchmark

by 0.35%, mainly due to the depreciation of the Renminbi.

Loan Administration

As at 31 March 2016, the Housing Society was managing 1,456 loans

granted under various loan schemes. During the year, 701 loans were

granted to borrowers under the Integrated Building Maintenance

Assistance Scheme, and a total of 146 second mortgage loans were

granted to purchasers of Heya Aqua, Heya Crystal, Heya Delight and

Heya Star. Meanwhile, 1,198 borrowers had fully redeemed or

partially repaid their loans, and legal proceedings were instituted

against 29 default borrowers, same as the preceding year.

長期投資組合為重建轄下的出租屋邨提供資

金。為趕上香港建築成本的上漲幅度,此組

合相當分散,且以股票為主。截至二零一六

年三月三十一日止,年度錄得百分之四點

八二的虧損,較指標高出百分之一點零五。

中期投資組合則為興建資助出售房屋項目提

供資金。此組合的風險較低,並以固定收益

工具為主。截至二零一六年三月三十一日止

年度,此組合錄得百分之零點三三的收益,

較指標低百分之零點四九。

由於短期投資組合的目標是保存資本及維持

資金流,我們繼續審慎地將現金盈餘投放在

不多於六個月的定期存款。受人民幣貶值所

影響,截至二零一六年三月三十一日止,

年度的短期投資組合回報為百分之零點零

九,較指標低百分之零點三五。

貸款管理

截至二零一六年三月三十一日,房協共管理

1,456

宗各項貸款計劃的個案。年內,房協

向借款人批出

701

宗「樓宇維修綜合支援計

劃」的貸款申請,以及向買家批出合共

146

宗

「喜漾」、「喜薈」、「喜盈」及「喜韻」的二按

貸款申請。同時,

1,198

名借款人已全數或

部分償還貸款,另已向

29

名拖欠還款的貸款

人提出法律訴訟,個案數字與去年相同。