Hong Kong Housing Society Annual Report 2014

66

Financial Management

財務管理

Financial Performance

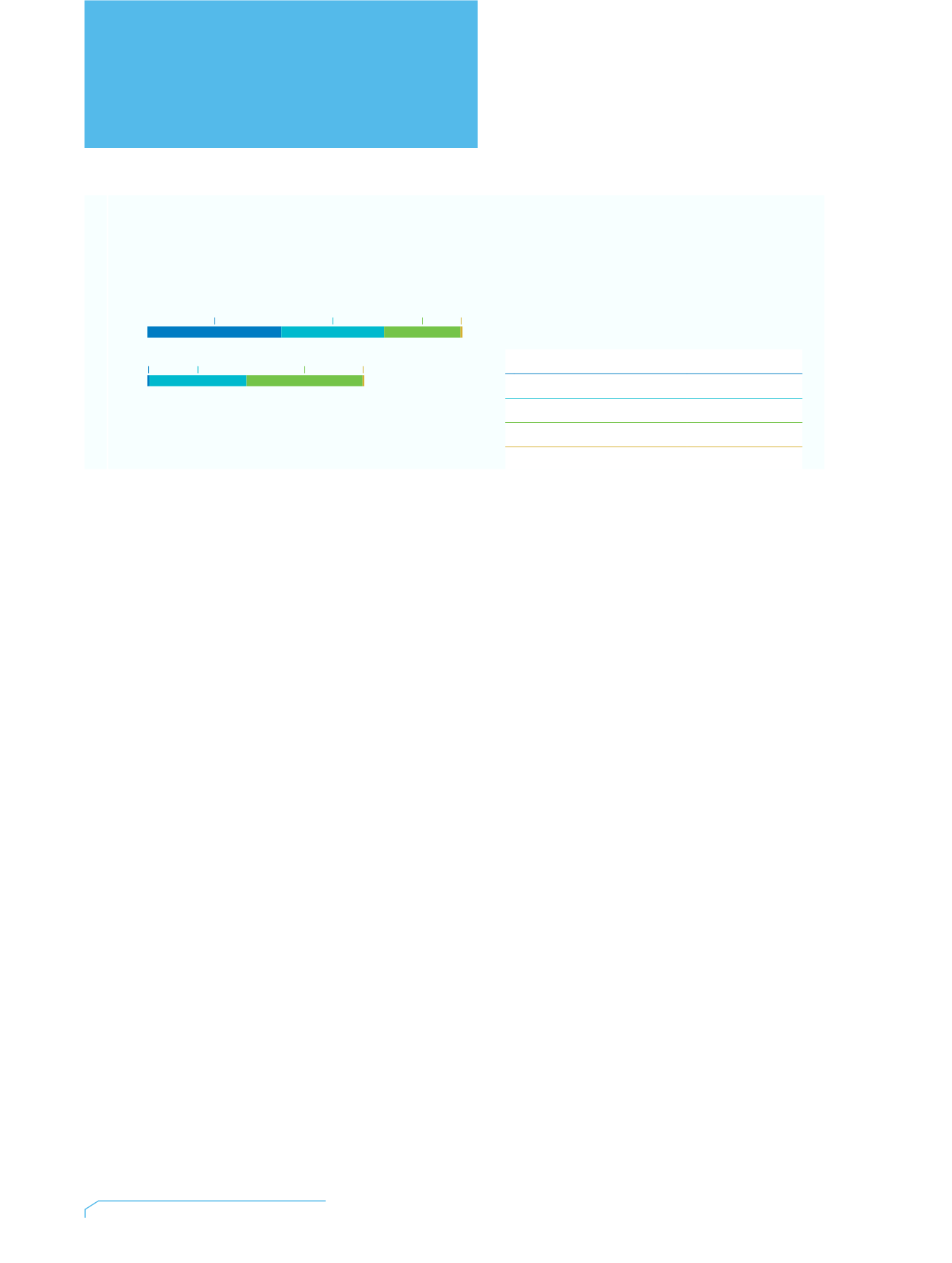

The total income of the Housing Society increased to HK$3,715 million

for the year ending 31 March 2014, which is HK$1,180 million higher

than last year. Contribution from property sales this year was partly offset

by the reduction in investment income.

Total expenses amounted to HK$2,261 million. Excluding property

development and related costs, expenditure went up by HK$114 million

this year to HK$1,140 million, mainly attributed to increased expenditure

on social projects.

Overall, the Housing Society achieved a net surplus of HK$1,454

million for the year. This included HK$903 million of investment gain,

of which HK$256 million was unrealised fair value gain of our securities

investment. Net asset value at 31 March 2014 stood at HK$32 billion,

represented by HK$9 billion in rental properties, HK$4 billion in

properties for sale, and HK$19 billion in financial assets and others.

Property Sale

Until this year, the Housing Society had not had revenue from property

sales since we disposed of the remaining Sandwich Class Housing

Scheme units in 2010/11. The Heya Green project in Sham Shui Po

brought in HK$1,581 million. Revenue from Harmony Place which has

been launched for pre-sale will be recognised upon project completion in

2014/15.

財務表現

在二零一四年三月三十一日截止的財政年

度,房協總收入增至三十七億一千五百萬港

元,比對去年增加十一億八千萬港元。物業

銷售的收益因投資進賬減少而部份抵銷。

今年的總支出為二十二億六干一百萬港元,

若不計算物業發展及相關成本,支出增加了

一億一千四百萬至十一億四千萬港元,增幅

主要來自社會項目的支出。

整 體 而 言, 房 協 本 年 度 的 淨 盈 餘 達

十四億五千四百萬港元,包括九億三百萬港

元來自投資回報,而當中二億五千六百萬港

元屬證券投資的未變現公允價值增長。截至

二零一四年三月三十一日,房協淨資產值為

三百二十億港元,包括出租物業九十億港元

和出售物業四十億港元,其餘一百九十億港

元為財務及其他資產。

物業銷售

自從二零一零至一一年度售完「夾心階層住

屋計劃」剩餘的單位後,房協在物業銷售項

目方面並無取得收益。直至今年,我們從深

水埗的「喜雅」項目獲得十五億八千一百萬

港元的進賬;而來自預售「樂融軒」的盈利

將於二零一四至一五年度項目落成時入賬。

Income Distribution

收入分佈

as at 31 March 2014

截至二零一四年三月三十一日止

Property Sales

物業銷售

Property Leasing and Management

物業租賃及管理

Investment

投資

Others

其他

3,715

2,535

13/14

12/13

1,586

1,219

903 7

8

1,146

1,376

5

HK$ Million

港幣百萬元

Year

年份